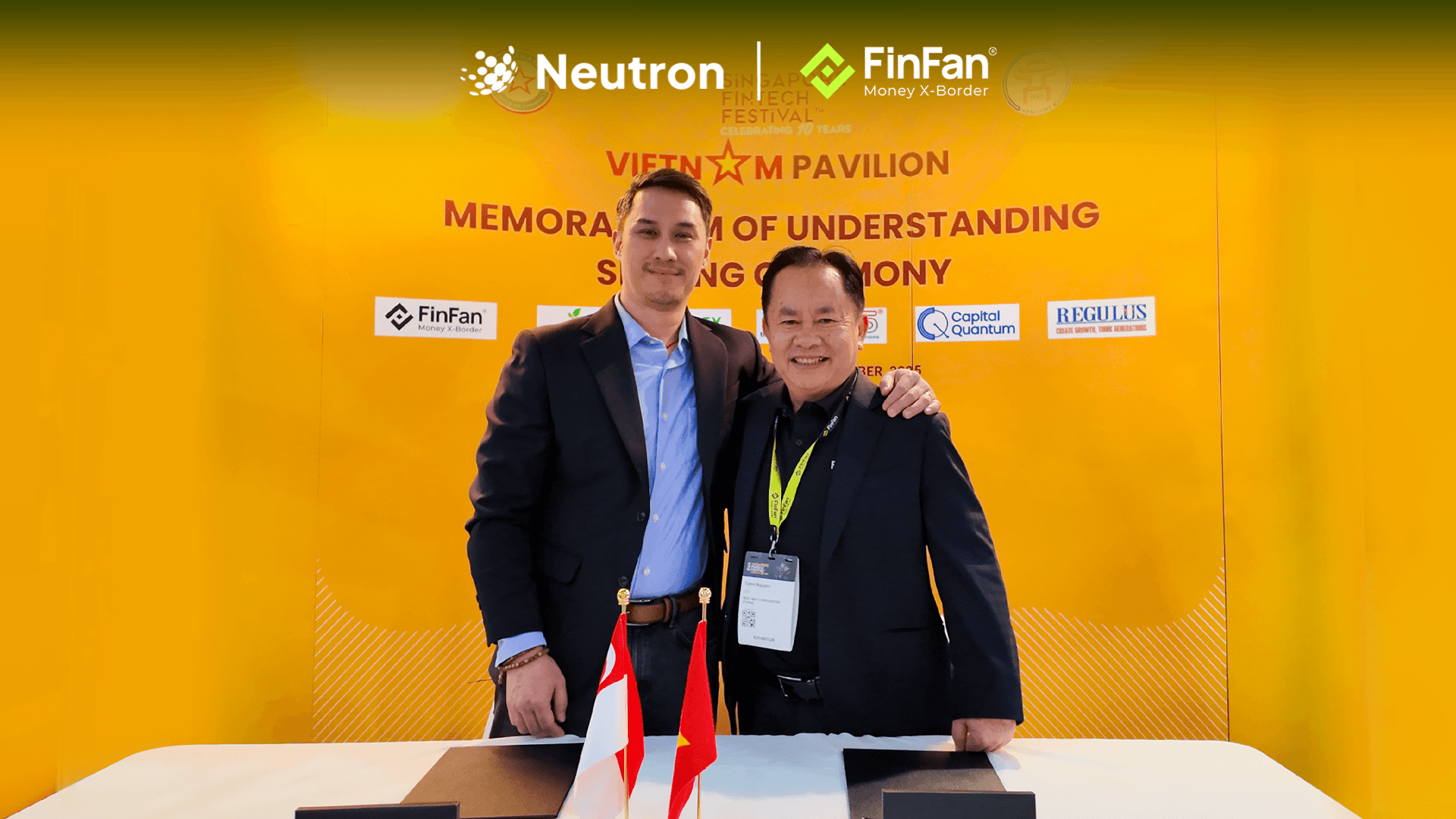

Kotani Pay and FinFan Partner to Expand Blockchain-Powered Remittance Rails and Cross-Border Payouts Across Continents

Kotani Pay, a leading financial technology company and Web3 infrastructure provider focused on enabling seamless on- and off-ramping of digital assets across Africa, is pleased to announce a strategic partnership with FinFan, Vietnam’s financial connectivity platform aggregating cross-border remittance flows. Together, the two companies will strengthen stablecoin liquidity connectivity and cross-border payment infrastructure between Asia and Africa.

This partnership positions FinFan as a key strategic gateway for inbound remittances in Vietnam, while Kotani Pay leverages Tether’s capabilities to serve as a primary liquidity provider for global partners. The collaboration is designed to unlock new cross-border corridors, enabling partners across Asia and Africa to access reliable liquidity and payout rails faster, more securely, and at significantly lower cost.

The Asia–Africa Corridor

The Asia–Africa corridor is rapidly emerging as one of the most critical pathways for global trade, remittances, and financial flows. Fueled by growing bilateral trade, strong diaspora ties, and a shared appetite for digital innovation, both regions stand to benefit from interoperable and cost-efficient financial infrastructure. As Vietnamese and African businesses deepen cooperation across manufacturing, agriculture, fintech, and commerce, the demand for real-time, reliable, and affordable cross-border money movement has never been higher. No

In both Vietnam and Africa, the demand for instant liquidity is intensifying, spurred by economic volatility, currency devaluation, and the need for efficient cross-border value transfer. Businesses and individuals are increasingly leveraging stablecoin-powered rails to facilitate remittances, B2B payments, and treasury functions more efficiently.

Vietnam has quickly emerged as a digitally innovative nation in Southeast Asia, while Africa continues to lead the globe in grassroots adoption of new financial technologies, particularly around digital asset utility. This partnership aligns with the growing preference for secure, transparent, and tech-enabled financial solutions in emerging markets.

Kotani Pay: Bridging Infrastructure and Liquidity

Kotani Pay stands out as one of the few African Web3 companies licensed as a Crypto Asset Service Provider (CASP), offering a fully compliant gateway to digital asset liquidity. Leveraging Tether’s global capabilities, Kotani Pay serves as a primary liquidity provider for global partners, ensuring it’s infrastructure connects seamlessly with mobile money platforms, banks, and cards, enabling real-world utility and accessibility. With a strong regulatory grounding and a vast network of liquidity partners, Kotani Pay delivers unmatched access to global blockchain-powered liquidity, transparency, and security. By integrating with the Kotani Pay API, merchants and global partners can also easily convert digital value to local currencies, unlocking smooth, secure, and compliant transactions. "We believe the future of finance lies in building infrastructure that transcends borders," added Felix Macharia, CEO of Kotani Pay. "By collaborating with FinFan, we are not only connecting liquidity pools but connecting economies, entrepreneurs, and everyday people across Africa and Asia."

A Gateway to the Future of Cross-Border

The Kotani Pay–FinFan alliance stands as a technological integration, a commitment to cross-continental collaboration and next-generation financial connectivity. For global partners and businesses, this partnership unlocks access to new markets, more competitive pricing, and greater control over their cross-border fund movements.

As the global economy demands faster, cheaper, and more transparent financial services, this partnership takes a bold step toward making borderless commerce a practical reality.

“For FinFan, blockchain technology is not only a technological enabler but also a real-time and transparent liquidity mechanism. By partnering with Kotani Pay (backed by Tether) and leveraging FinFan’s extensive banking connectivity, we are extending our cross-continental liquidity network and cementing our position as the strategic bridge connecting global digital asset liquidity with Vietnam's local banking system, while empowering SMEs, workers, and enterprises and global partners across both continents to access faster, more transparent, and more affordable payout rails.” Nguyen Tuyen, CEO of FinFan

About FinFan

Founded in 2007, FinFan (Best Way Corporation) is a pioneer in Vietnam’s fintech sector, licensed by the State Bank of Vietnam as an International Remittance Operator. As the pioneer in Vietnam enabling cross-border payouts directly to e-wallets, FinFan serves as a financial bridge for the Vietnamese diaspora and a trusted partner for global Money Transfer Operators (MTOs), banks, and fintech platforms, operating as a central aggregator that leverages the licensed capabilities and connectivity of the domestic banking ecosystem and global partners. Today, FinFan plays a leading role in Vietnam’s digital financial transformation, advancing embedded finance and inclusive cross-border payment solutions.

About Kotani Pay

Kotani Pay is a licensed blockchain orchestration infrastructure. Licensed in South Africa and a strategic portfolio company for Tether operating in more than 11 countries, we provide stablecoin liquidity to businesses empowering them to seamlessly convert their digital assets into local currencies with unmatched ease and efficiency.Through Kotani Pay’s API, global partners can easily access deep liquidity pools and Alternative Payment Methods, including mobile money, bank, and card payments, with one integration.